Payroll Diversion Fraud and Accounting Negligence

Payroll diversion and accounting negligence are two of the most common types of fraud that can occur in any business. Even if your company has the best accounting systems in place, these issues can still be difficult to identify and prevent.

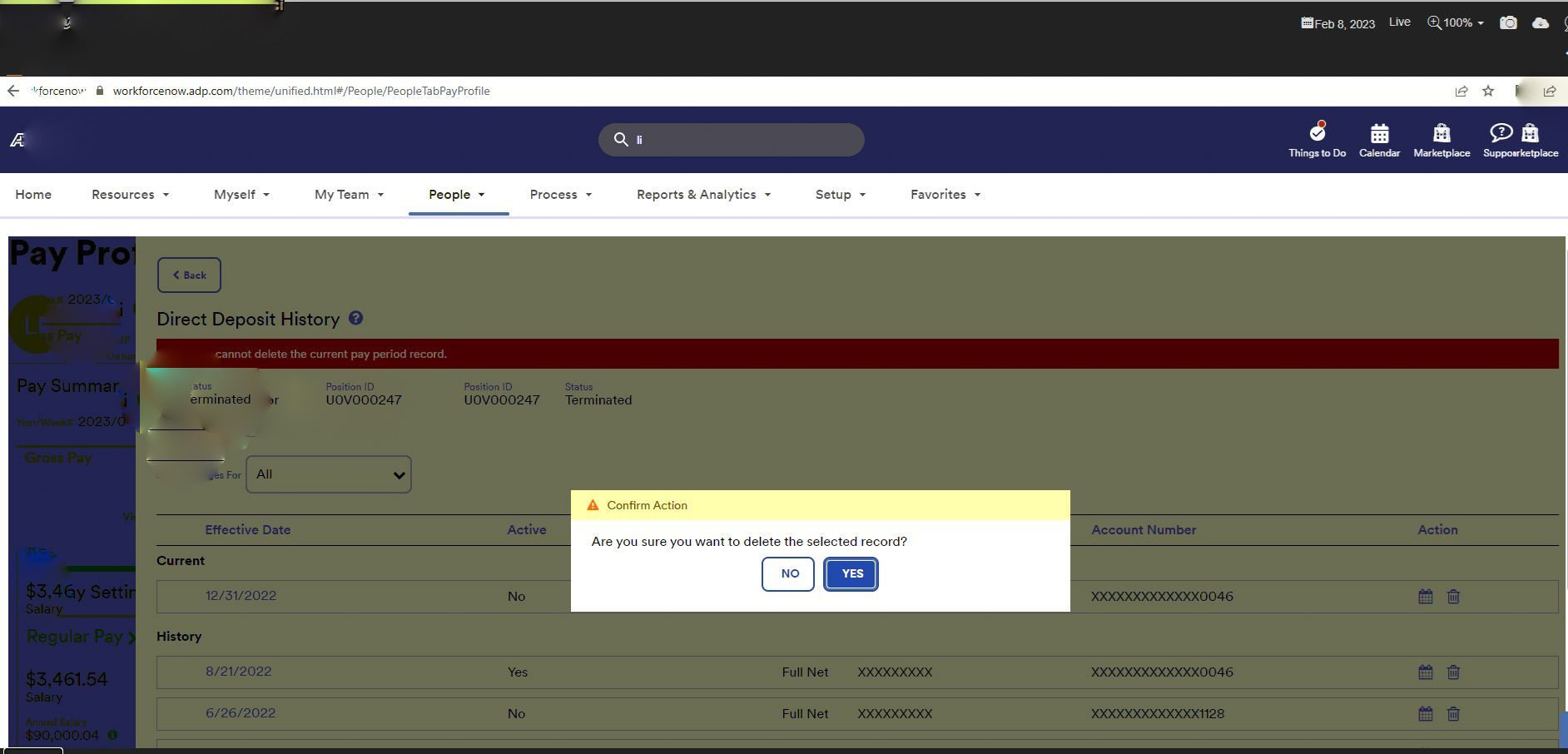

The first step to protecting your company from payroll diversion and accounting negligence is to understand the warning signs. Payroll diversion fraud occurs when someone diverts money from an employee’s paycheck, commonly for their own benefit. Examples of this type of fraud include stealing from payroll accounts, using employee data for personal gain, and creating fake accounts to siphon money.

Accounting negligence, meanwhile, is when a company fails to properly record and report financial transactions. This can occur due to poor internal accounting practices or when dishonest employees manipulate the books.

To help identify these issues, you should have a thorough financial audit process in place. This should include regular reviews of your payroll and accounts payable systems, which can help to spot potential problems. Additionally, you should be on the lookout for any signs of unusual employee behavior. If someone is diverting payroll funds or committing accounting negligence, they are likely to display suspicious activity.

Finally, you should make sure that you have a clear and detailed set of policies and procedures in place to protect your company from fraud. This should include providing thorough training to employees and setting up controls to monitor any financial activities.

By understanding the warning signs of payroll diversion and accounting negligence, and taking the necessary steps to protect your business, you can help to prevent any potential fraud or negligence.

Services

- Hard drive Forensics

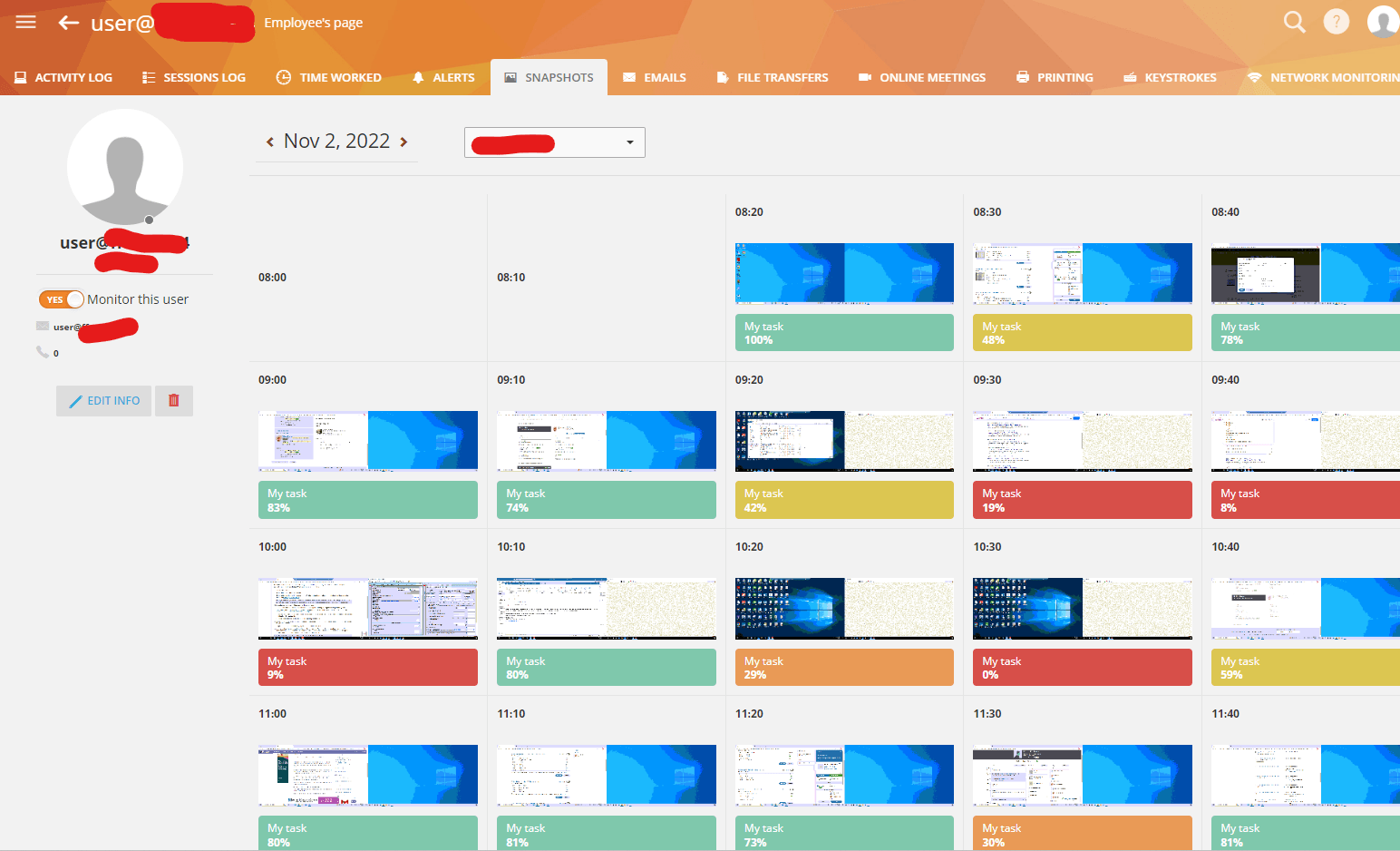

- Real-Time incognito pc/mac monitoring

- Data Recovery

- Key logging

- Internal Espionage monitoring

- Employee / Other online activity